In the classic 1970s sci-fi fantasy ‘The Hitchhikers’ Guide to the Galaxy’, Arthur Dent – resplendent in dressing gown and slippers – escapes the destruction of his West Country village, and the rest of Earth with it, to stowaway on a spaceship belonging to the Vogons, a hostile alien race responsible for the impending demolition.

Arthur is desperate to understand a tannoy announcement by the Vogon Captain, which he describes as sounding like ‘a man trying to gargle whilst fighting off a pack of wolves’.

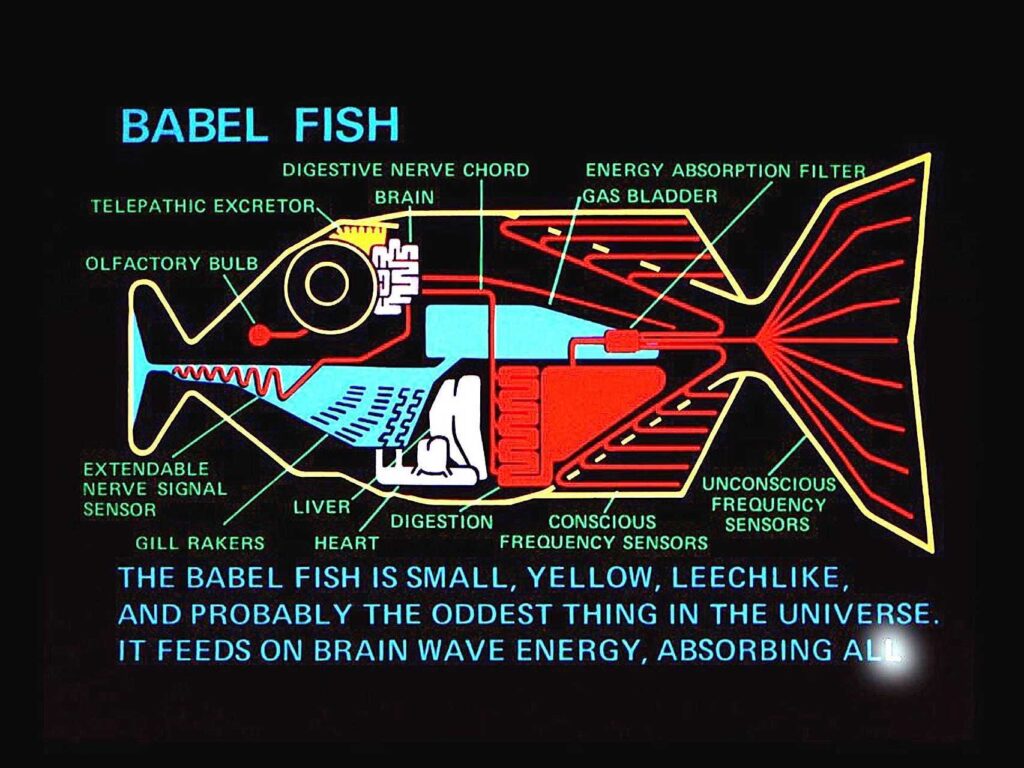

Though the day had already been somewhat out-of-the-ordinary, Dent was confused when his hitchhiking guide – Ford Prefect – tells him to put a small yellow Babel Fish in his ear.

He is however, pleasantly surprised when it magically turns the incomprehensible Vogon gargles into perfectly comprehensible English.

I think that many people – JK Rowling included – feel like Arthur Dent listening to Vogon when someone tries to explain Bitcoin to them. Unfortunately technology hasn’t quite caught up with Douglas Adams’ imagination, so there is no Babel Fish and Bitcoin speak isn’t in the dropdown for Google Translate.

Amusing analogies aside, this is a really important issue for Bitcoin adoption, but one that I hope to explain in less than 10 minutes, is eminently fixable.

Bitcoin is what is known as a discontinuous technology; Babel Fish translation. Bitcoin, as a new form of money, doesn’t look and function like the money that most people are used to.

It involves different technology and processes, and offers financial sovereignty for anyone with an internet connection willing to take full ownership of their own money. That potential has created an army of believers, but for the uninitiated, it is still just Vogon.

Jumping the Chasm

At this point I could launch into a description of how clever Bitcoin is on a technical level and fall into the trap that seems to catch a lot of well-meaning Bitcoin evangelists aka hodlers.

Though it isn’t so much a trap, then a chasm, a chasm between different adoption groups who – like Arthur and the Vogon Captain – talk different languages and are interested in totally different things that a new technology, like Bitcoin, can offer.

The idea of this chasm comes from the Diffusion of Innovation Model by Everett Rogers. In 1962, Rogers, then assistant professor of rural sociology at Iowa University, published the seminal work – Diffusion of Innovations – a way of mapping out how and why new ideas and technologies spread.

His research was in part inspired by a body of work around how innovations spread within rural farming communities, reflected in his own father’s reluctance to adopt biological adaptations of seed as quickly as new farm machinery.

Rogers’ work was a meta-study, pulling from 508 other studies across multiple disciplines, into what is recognised as one of the most credible frameworks for diffusion of any innovation, and though there is nuance, at its heart is relatively simple.

Rogers’ model suggests adoption of a new idea follows a familiar trajectory across distinct groups of varying size with distinct characteristics neatly summarised in a ‘normal’ (bell curve) distribution shaped chart.

A critical part of his idea was that any new technology can quickly move from Innovators to Early Adopters because, though their interests may be different, they share common ground.

They may both be focused on the science though for different reasons; with Bitcoin this means Innovators may be focused on the huge potential uses for cryptography or blockchain technology (Babel Fish alert) while as Visionaries, the Early Adopters might see its potential as transforming developing economies by providing access to banking.

What’s In It For Me?

Now that’s all very interesting and noble, but the larger group of the Late Adopters tend to be very pragmatic. They simply want to know ‘what is in it for me?’ which is the reason why the chasm is a perilous part of the adoption path, because crossing it is a bit of a Catch 22 situation.

Late Adopters tend to listen to…well other Late Adopters. And right now many people (me included) think Bitcoin is trying to jump that chasm, with the groups either side speaking Vogon and English.

As if that wasn’t bad enough, a tangible benefit isn’t enough, on its own, to convince those pesky pragmatists that they are late to the Bitcoin party.

A large proportion will already be reasonably happy with the way their contactless cards, Apple/Google Pay, or eWallet (Paypal/Venmo) work, thank you very much. To convince them to try a new magical internet money, it needs to be more than just a bit better. So here we get to the crux of the Bitcoin Babel Fish issue.

If you want to hit the motherload of new adopters, don’t start by telling them what Bitcoin is, how it was created, how it works or even who created it. Tell them in very simple, familiar and specific terms what it can do that matters to them.

This is what has already driven adoption for pragmatists attracted by the solution Bitcoin solves for a specific problem:

Gamblers – Bitcoin’s borderless and permissionless qualities is a clear solution to gamblers previously restricted from online services through their traditional payment providers or national laws.

The Unbanked – Many in developing nations find it difficult or impossible to access traditional banking. With Bitcoin you just need a smartphone and internet connection.

Victims of Hyperinflation – For those facing hyperinflation looking for an alternative store of value.

Overseas Workers – International remittance (sending money overseas) is a huge business and also a huge rip-off. For too long services like Western Union and Moneygram have been overcharging workers sending money home to their families from wealthy nations in North America, the Middle East and Europe.

Remittance accounts for 10% of the Phillippines’ GDP. Bitcoin offers a cheaper and more convenient alternative.

The global average cost of sending $200 remains high at 6.8 percent in the first quarter of 2020

World Bank Report

Illegal goods/services – For those wanting to buy and sell them via illegal goods Bitcoin became the darknet markets for drugs (not condoned btw)

These groups are conspicuous in generally applying outside Europe and North America, which shouldn’t be a surprise as this is the fault line of economic inequality.

Nevertheless, there is a pressing use case for those in Europe and North America who may feel that their money works fine, thanks very much. It is tangible and important to anyone with money. Interest on savings.

Right now retail banks in Europe are seriously considering negative interest rates, in other word charging customers for the privilege of looking after their money. People might be forgiven for not really noticing (or understanding) that inflation has surreptitiously and continuously been picking their pocket, but the day they get a letter from their bank – plain English, not Vogon, or Bitcoin babble – explaining that a ‘Savings Account’ will actually cost them money, the penny might start to drop.

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.