Why can’t you create your own money? Fuck about and find out. While historical punishments for counterfeiters and coiners included being fed to wild beasts or hung, drawn and quartered, the modern protection of monetary privilege is more subtle but no less determined.

Ask a child, “What’s the easiest way to make money?” they’d probably tell you to make your own. The thing is, those who control money are a bit touchy about anyone muscling in on their privilege. Up until the early 19th century, counterfeiters and coiners faced a macabre combination of execution and mutilation. Modern punishments might be less savage, but from Liberty Coin to crypto, central banks remain intolerant of people creating their own money.

Money, power & punishment

What is money? Despite our obsession with money, we can’t even agree on a clear definition, but one thing is for sure: from Rai Stones to Wampum, societies worldwide independently introduced different forms of money without seeking anyone’s permission.

As civil structures emerged, the function of creating and managing money ended up in the hands of the increasingly small groups that wielded power and understood the importance of that monopoly of money creation, protecting it with increasing levels of violence and brutality.

Damnatio ad bestias – How Roman coiners were condemned to the beasts

The strength and size of the Roman Empire were in part attributed to the success of its monetary system. The Roman punishment for any form of coining – counterfeiting, coin-clipping – was a prelude to the violent protection of the money supply by the state down the ages.

During the reigns of Julius Caesar and his adopted son, Augustus, the lex Iulia peculatus sentenced coiners to a very specific and gruesome punishment – damnatio ad bestias or if your Latin is rusty, condemned to the beasts.

Roman-era coin clippers and counterfeiters would be bound and torn to pieces by wild animals for entertainment, alongside traitors, deserters and sorcerers.

Though the Romans set a high bar for violent protection of monetary sovereignty, the Kings and Queens of England found even more inventive ways to deter would-be forgers.

From 1562, coining was punishable as treason, which meant being dragged to the gallows on a makeshift fence, hung until close to death (but not quite dead), castrated and disembowelled before the relief of decapitation.

But that wasn’t quite the end of the punishment for coiners; as a final denouement, their lifeless torso was hacked into four pieces and presented to the monarch.

Freedom of speech, not to choose money

Even when new societies with new ideas were formed across the pond, the same protectionist attitudes about money prevailed.

Counterfeiting is one of the two criminal offences name-checked in the US Constitution, which enshrines both the right of the state to create money and to punish counterfeiting.

[the right to] coin Money, regulate the Value thereof, and of foreign Coin…provide for the Punishment of counterfeiting the Securities and current Coin of the United States

US Constitution

The Coinage Act, created in 1792, four years after the constitution was ratified, created the US Mint, manifesting the power of seignorage in the newly formed state.

Contemporary measures for protecting monetary monopoly

Though today you won’t get your guts ripped out for creating your own money, it will land you in front of a court, whose power is ultimately backed up by aircraft carriers and nuclear warheads.

As a result, modern levels of counterfeiting, though nominally large, now represent a tiny proportion of the overall money supply, largely modern because it is mostly digital.

Nevertheless, as technology has changed, banks have attempted to stay one step ahead of the new breed of counterfeiters.

Rules for use & the CBDCG

rulesforuse.org is the kind of curious website that goes down well on TikTok. It’s the official website of the Central Bank Digital Currency Group (CBDCG), which may not sound like viral material, but try photocopying or scanning a banknote issued by one of the 30-member currency issuers, and that’s when the magic happens.

Instead of getting a facsimile of a £50, €50 or $50 note, you’ll see a printout of the Rule for Use website because the CBDCG was established to “deter the use of personal computers, digital imaging equipment, and software in the counterfeiting of banknotes.”

Markus Kuhn, a computer scientist from Cambridge University, is credited with the discovery back in 2002 when trying to copy a £20 note with an early colour printer.

The banks clearly anticipated the counterfeiting risks that digital printing would bring but may have been surprised when a surfer from Hawaii decided to create a rival to the official US currency, the Liberty Dollar.

How the US squashed the Liberty Dollar

The silver-backed Liberty Dollar was launched on October 1st, 1998, by self-declared monetary architect Bernard von NotHaus, who believed silver was a superior store of value to the official US Dollar.

Produced by the niftily named NORFED (National Organisation for the Repeal of the Federal Reserve Act and the Internal Revenue Code), the Liberty Dollar was issued in rounds of $1, $5 and $10, representing a receipt for a tenth, half or a Troy ounce of silver, stored in a warehouse in Idaho.

Liberty Dollars were billed as worth 100% of their value in silver and fully redeemable, but not only did the value of silver fluctuate, but ALD was sold at a premium to the face value in silver to cover production costs.

Ten ALCs, purchased for $10, are backed by one ounce of silver, whose recent spot price was $5.50. That means any exchange from ALCs back to dollars involves a 45% cash loss.

Funny money, Forbes – April, 2000

Anyone American can create a voucher-based currency, like Disney Dollars or Ithaca Hours, so long as there is no claim to being legal tender or intention to function nationally. Unfortunately, von NotHaus’ ambition might have been his downfall.

In November 2007, the FBI raided the Idaho warehouse where NORFED kept its silver, and though von NotHaus valiantly continued his monetary crusade, distributing ALD until 2009, to quote the Clash, von NotHaus fought the law, and the law won.

He was convicted in 2011 accused of being a domestic terrorist and passing off his silver coins as US currency. Von NotHaus faced 22 years in prison but, on appeal in 2014, was sentenced to only six months home detention and three years probation, with the Judge recognising there was no intention to produce a counterfeit dollar.

Why alternate UK Currencies were tolerated

Though the evidence so far demonstrates that central banks don’t take kindly to anyone muscling in on their territory, the proliferation of alternative currencies in the UK at the turn of the century illustrates that there is a level of tolerance.

There was a movement, funded by EU’s Community Currencies in Action initiative, to stimulate local economies through localised alternative currencies.

The UK saw variants of Sterling spring up in Brixton, Exeter, Lewes, Stroud and Totnes, with the locus in the South West due to the Bristol Pound, which was the largest experiment from 2012-2020.

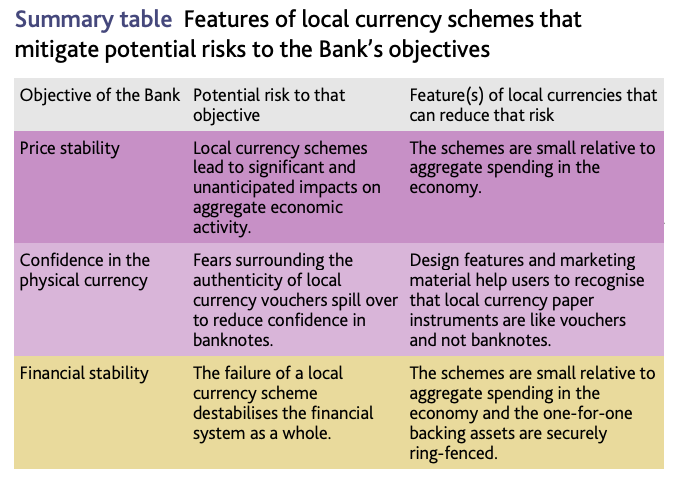

The Bank of England’s position on these alternate currencies can be summarised as “we’ll allow them so long as they remain small enough not to be a threat.” Which should have been a warning to the crypto community.

Bank Objectives – Report by The Bank of England

The unique challenge of decentralised money

Though authorities might have anticipated printing technology, they weren’t prepared for the emergence of decentralised money, like Bitcoin, which now finds itself in a battle with regulators and central bankers.

But Bitcoin is battling without a commander in chief. Not only is its creator, Satoshi Nakamoto, pseudonymous, but they abruptly ceased all communication days after a close collaborator on the project mentioned he was meeting with the CIA to discuss the fledgling money.

Um, I haven’t had email from [Nakamoto] in a couple of months, actually…The last email I sent him, I actually told him I was going to talk at the CIA. So it’s possible that… that may have had something to do with their deciding [to leave].

Gavin Andresen, The Bitcoin Show, 2011

The crypto community, essentially a wave of new monetary upstarts, sees central and private banks working in concert to protect the status quo from the challenge of a new form of sovereign money.

From wait & see to CBDC

Though messing with money is no longer regarded as a capital offence, the unofficial war on crypto has seen power over monetary creation exercised in other ways.

Initially, authorities exercised a wait-and-see approach, perhaps expecting cryptocurrencies to either fail or fade away. As the market capitalisation of cryptocurrencies like Bitcoin continued to grow and become globally recognisable, ignoring them clearly wasn’t working, and a two-pronged approach of regulation and replication is now being used.

Some see crypto regulation as both productive and necessary, others as a means to stifle growth and give central banks time to introduce their own dog into the fighter – Central Bank Digital Currencies (CBDCs).

CBDCs are a form of Frankenstein money, cherry-picking some of the benefits of distributed ledger technology along with the more sinister elements of surveillance capitalism.

China, swiftly becoming one of the most authoritarian governments and therefore demanding complete control over money, has effectively banned crypto and is furthest along the path to a full CBDC, expected to dovetail with a system of social credit scoring.

The treatment of the three creators of Tornado Cash, a means of obfuscating the traceability of crypto, shows how the game is changing. Two have been arrested (one in Holland, one in the US) while the US Office of Foreign Asset Control has sanctioned a third remains at large, and the service.

The main concern was that Tornado Cash was facilitating the washing of $1bn of crypto hacked by the Lazarus Group, a North Korean state-sponsored crime syndicate.

Privacy advocates protest that creating code shouldn’t be a crime, any more than making a colour photocopier or a pair of sheers, but as history has shown, those who control money will punish those they consider a threat to that privilege.

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.