Explaining the concept of expected value, a simple method for weighing up risk-vs-return and how it can be used for everything from gambling to everyday decisions.

The most effective way to weigh up decisions that involve quantifiable risk is through a calculation called expected value, or EV for short. Professional gamblers and poker players are constantly looking for +EV situations to profit from. The average punter, however, will fall back on instinctive decision-making, such as relying on their gut or more limited analysis, such as reviewing form tables.

The thing about EV is that it can be a valuable tool for any quantifiable decision and, as a general mindset, can help develop a wariness of free lunch-type scams. So, it’s worth spending 10 minutes understanding how to calculate expected value.

An introduction to Expected Value

Every day, we make hundreds of decisions, from whether to leave the house without an umbrella or which queue will be fastest at the supermarket. Yet the average person spends surprisingly little time thinking about how they reach decisions and whether the process is effective.

The sheer volume of decisions, most of which are relatively inconsequential, means that it is impractical to scrutinise the pros and cons of each.

The same was true of our ancestors when faced with more life-threatening scenarios, which is why we developed the ability to make decisions on the fly. A specific part of the brain, the Limbic System, enabled hunter-gatherers to evolve a survival instinct; otherwise, I wouldn’t be writing this, and you wouldn’t be reading it.

Our ancient decision making system

Over time those instincts have been codified into helpful heuristics, rules of thumb, that enable us to navigate the world around us, such as red=danger or interpreting the body language of fellow humans.

You can even think of the Limbic System as a source of common sense which has been translated into proverbs.

- Look before you leap.

- Measure twice, cut once.

- Better out than in 😉

The problem is that many of the decisions we must make in the modern world aren’t suitable for the fight-or-flight type assessment of our Limbic System and can’t be resolved via a proverb.

Decisions that involve assessing probability are our biggest weakness because trying to break down your chances of taking down a woolly mammoth into numbers wasn’t a practical solution.

Unfortunately, that decision-making blind spot covers everything related to money, especially taking risks with it, like gambling or investing.

What makes matters worse is that marketing weaponises our decision-making shortcomings and uses them against us. Our default response, faced with confusing numerical information, is to fall back on rule-of-thumb thinking instead of using a system, like expected value.

Here’s how expected value works

Expected value is a relatively simple calculation, so long as you have the numbers to feed into it. As any experienced number cruncher will tell you, Garbage In, Garbage Out, but with that caveat in mind, here are the inputs and the formula for risk-based decision-making using expected value.

- The probability of a specific outcome happening

- What you’d win

- The probability of the outcome not happening

- What you’d lose

To make it easier to wrap your head around, we can apply those four inputs to betting £10 on black at a standard Roulette table, with 36 numbers equally split between red and black, plus 0. We then arrange the input into an equation and calculate the expected value.

- The probability of the ball landing on black (18/37)

- What you’d win – £10

- The probability of the ball landing on red or 0 (19/37)

- Your stake (£10)

These four inputs are then arranged as follows:

Expected Value=(Win Probability*What You’d Win)-(Probability Losing*What you’d lose)

So, applying this to our Roulette example:

Expected Value=(18/37*10)-(19/37*10)=-0.27

This tells you that each time you place a single red or black bet on a Roulette Wheel with 37 numbers, you should expect to lose 27p, which is a 2.7% edge for the house.

An expected value that is negative tells you that the odds of that proposition are weighted against you. This doesn’t mean that casinos are cheating; this is just how gambling works and is just the mathematical confirmation that ‘the house always wins’.

The probability of the outcome in the proposition/bet isn’t fair; the games is arranged to ensure that the casino makes a profit. Bookmakers and lotteries work in precisely the same way.

The odds offered on sporting events don’t reflect the underlying probability, which is true of casino games. Those within the gambling industry call this edge the margin or juice, but you can think of it as the cost of placing a bet or playing a casino game.

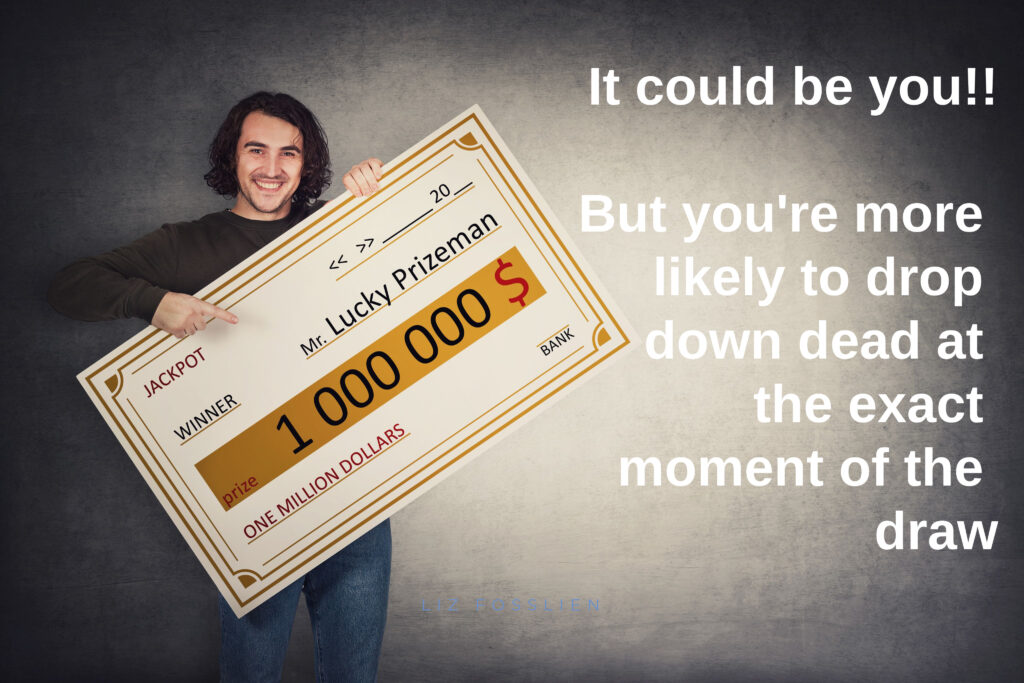

The idea that a lottery is just a tax isn’t very intuitive because you’re probably thinking that someone’s gotta be in that photo with a huge comedy-style cheque and magnum of champagne, so why couldn’t it be you?

Longshot Bias

EV tells you that you might as well walk up to a UK National Lottery counter and hand over £1.05p and not bother filling in a ticket. It is, in effect, an indirect tax of 52.5% on your stake.

But humans are very good at creating narratives and focusing on desired outcomes, such as winning the lottery and being showered with Bollinger. This is why the UK Lotteries tag line is ‘Dream Big Play Small’ rather than ‘You’re guaranteed on average to lose 1.05p for every £2 you stake’

Rather than making mathematical assessments, how we visualise preferred outcomes leads us to overestimate unlikely events – known as the longshot bias.

We’re less inclined to focus on less beneficial events from a statistical perspective but actually more likely, such as having a heart attack at the exact moment of the draw and falling down dead. [H/T to ‘Taking Chances’ by John Haigh\]

How to utilise expected value

Though learning about expected value might feel like taking the first peak behind the wizard’s curtain, it won’t turn you into the Wolf of Wall Street overnight. It is just the first step in being a better gambler or investor.

Just because you find an event with a positive expected value, where the odds are actually in your favour, it doesn’t guarantee you win. It just means that you’ll win over the long run if you continually make +EV bets, just as continually betting with negative EV guarantees you will lose in the long run.

And calculating expected value isn’t the end of the story. Because the size of the edge your favour will vary for each proposition you are looking at, you need a system for adjusting how much you’re willing to risk. Stake management is an entirely separate discussion, but a good place to start is Kelly Criterion.

Examples of +EV Opportunities

It should now be clear that lotteries, bingo, sports betting and casinos all offer negative expected value – i.e .you will lose in the long run – to all but those who take a systematic approach to measuring risk and only play when the edge is in their favour.

Before you get excited, being a professional gambler takes a huge amount of commitment, bankroll and discipline, and even then, it can be a grind with single-digit % returns. With your expectations suitably managed, let’s look at some common scenarios that offer positive Expected Value.

Card Counting in Black Jack

The aim of Black Jack is to get an Ace and a picture card (King/Queen/Jack) – the perfect hand. Card Counters keep track of the cards that have been dealt (usually from a six-deck Shoe) to know how many Aces and picture cards are yet to be dealt. When the odds are in their favour of getting Black Jack or close to 21, they increase their stakes proportionately and make all the necessary calculations on the fly.

The house always has an edge without tracking cards, but card counting can mean playing Black Jack provides positive expected value.

Ball Clocking In Roulette

As our expected value example showed, the zero on a roulette wheel gives a casino a constant edge against its gamblers.

But some very smart people figured out that by measuring the speed of the ball, you could predict where the ball might land with enough accuracy to profit.

Unfortunately, ball clocking is as complicated as it sounds, and casinos constantly look for nerd punters with stopwatches or, more realistically, micro-machines strapped to their legs.

Lottery Rollovers

As our example above shows, playing the lottery offers a negative expected value except in circumstances where the Jackpot isn’t won, and the rollover is big enough to produce a +EV situation.

In October 2015, the UK National changed its rules. Instead of choosing six numbers from 1 to 49, entrants had to pick from 1 to 59, and the cost of entry increased to £2.

This increased the odds of winning the Jackpot from 1 in 14 million to 1 in 45 million, and for a theoretical Jackpot of £10 million, the expected value was minus 78p. In other words, you’d expect to get back £1.22 for every £2 entry.

- (1/45,057,474) x £10,000,000 – £2 = -£0.78

The side effect of making the Jackpot harder to win was to increase the chance of a rollover. In January 2016 for the only time in its history, the expected value of the UK National Lottery turned positive, calculated at £4.50 according to auditing firm KPMG.

- Read our article on how Roman Mandel won 14 lotteries by focusing on rollovers and positive expected value.

Arbitrage

Arbitrage exploits the differentials in odds/prices across different exchanges or bookmakers for the same events/markets to manufacture a positive EV outcome. With odds and prices available in API feeds, it’s relatively easy to write a script in a language like Python that matches the best available quotes. The trick is funding accounts across hundreds or possibly thousands of potential providers and hoping they don’t block you.

Arbitrage doesn’t just work in sports betting; it is one of the main ways investment bankers make money.

If Arbitrage interests you, read our article about the Kimchi Premium, which describes the differential between Bitcoin’s elevated price on exchanges in Korea compared to other international exchanges.

Poker

The skill of a professional poker player is mixing expected value with psychology. EV calculations tell you the chances that other players hold better/worse hands than you based on the visible cards that have been dealt. Successful poker players combine that objective measurement of risk with what their opponents’ body language is telling them, not betraying their own emotions.

Pepsi: Where’s My Jet

The Netflix Series Pepsi: Where’s My Jet‘ documents the battle between a teenage boy and Pepsi over a claim the firm made in a TV commercial offering a Hawker Harrier in exchange for 7,000,000 Pepsi points.

Though Netflix focuses on the David and Goliath nature of the battle, the story is about expected value. John Leonard realised that you could buy 7 million Pepsi points for $700,000, as described by the terms of the campaign, to gain a fighter jet worth approximately $32million.

That opportunity clearly presented positive expected value based only on the financial arbitrage, but that didn’t account for the risk that Pepsi wouldn’t honour their advertisement, which in their opinion, was meant as a joke. Watch the Series to find out whether Leonard’s gamble paid off.

Expected Value in everyday life

Because there is no such thing as a free lunch, taking advantage of positive expected value opportunities such as those listed above isn’t easy, despite what you might find on Youtube.

Occam’s Razor – if it were that easy, everyone would be doing it, but it doesn’t mean that the idea of expected value is pointless.

Thinking in terms of expected value forces you to accept that without a ton of homework, betting, casino games and lotteries will lose you money in the long run. It doesn’t mean you shouldn’t indulge, so long as you see the likely loss as simply the cost of entertainment. But the value of EV doesn’t end there, as you can apply the mindset to everyday life.

William MacAskill’s recent book, What We Owe The Future, takes a fascinating look at what the future might hold and how we can influence it.

When thinking about the changes we could make to the world, we will not know how long they will last or how significant or contingent they will be. So we need a way of making decisions in the face of uncertainty. The most widely accepted account of how to do so is expected value theory

https://whatweowethefuture.com/uk/

Without turning this piece into a book review, MacAskill uses expected value as a framework for calculating what the future holds for all of us, taking inspiration from his housemate, Liv Boeree, who happens to be a professional poker player. Boeree and her partner, also a poker player, apply EV to other areas of their life, such as calculating ‘the probability they’ll be together in ten years”.

The digital age is already helping us out; weather forecasts use probabilistic models, so we don’t have to work out whether it’s gonna rain, and satnav will calculate the fastest route based on up-to-the-minute traffic conditions, so we don’t have to fly a drone over the M25. But there isn’t an app for every decision.

Of course, we started this article by explaining how using complex decision frameworks in everyday life is impractical and, taken to an extreme, would turn us into robots, robbing us of the essential evolutionary ability to dream big. So the trick is finding the right balance and adapting your thinking to incorporate expected value.

Expected Value is a mathematical calculation for assessing the theoretical profit/loss of a risk-based proposition, such as a bet.

Expected Value calculates the probability of a specific outcome happening from four inputs:

What you’d win, the probability of a winning outcome;

What you’d lose, the probability of a losing outcome;

These inputs are combined in a formula:

Expected Value=(Win Probability*What You’d Win)-(Probability Losing*What you’d lose)

The expected value of wagering on a roulette wheel landing on red or black is 97.3%. In other words, for every £10 bet placed on red or black, you would, theoretically, lose 27p.

No Free Lunch

There is no such thing as a free lunch, but if you’re hungry to find out why, we’re here to help.

You can learn the meaning and origin of the no free lunch concept, as well as the broader philosophy behind the idea that nothing can ever be regarded as free.

We look at our relationship with money and truth, examining all of the supposed shortcuts, life hacks and get-rich-quick schemes.

2 comments

Comments are closed.